gst on commercial property malaysia

With the current tax holiday commercial property buyers will definitely save some cash. Meanwhile other building materials fall inside Second Schedule Goods in which all the goods in this category will only be charged sales tax of 5.

Update On Gst And Commercial Property In Malaysia Taxation News

Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is.

. The remaining 60 will be subject to GST because it is a commercial property. Stamp Duty The stamp duty increases progressively as follows. The tax is calculated based on the annual rental value of the property which is then multiplied by a fixed rate.

In Malaysia a person who is registered under the Goods and Services Tax Act 2014 GSTA is known as a registered person. Commercial property is defined in the A New Tax System Goods and Services Tax Act 1999 GST Act. A 6 GST is applicable when you buy a commercial property from the seller who is GST-registered.

A registered person is required to charge GST output tax on. However recent guidance released by the authorities could bring private individuals who would not consider that they are in business into the mix. Below Ive listed the taxes you normally need to pay when investing in Malaysia commercial property.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input. On the other hand if you an unregistered GST buyer you will not be able to claim back GST for. The GST payable on commercial properties does not become part of his cost of doing business.

Goods and Services Tax GST is a multi-stage tax on domestic consumption. This can range anything from 2 to 9 depending on whether the. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

Yong of TAMS concludes there is no point. The Conclusion There is lot of confusion and chaos among landlord and tenants in case of applicability of GST on Rent on. An RM1 million commercial property unit will cost you RM60000 in GST.

Any tenancy lease easement license to occupy of a commercial property is a supply of services therefore GST applies. Sale of residential property is GST exempt. To illustrate a simple analogy would be as follows-.

In some cases businesses are also entitled to a GST Refund from Customs. This can happen when a there is a purchase of commercial land or a completed commercial building and the. Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST.

Criteria of commercial property owners who have to be GST-registed. Under the new GST. GST on Rent on Residential and Commercial Property.

The Royal Malaysian Customs Department has recently issued a new guidance that would result in more people being subjected to the Goods Services Tax GST when they sell. Under GST the sale of commercial. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

While there may be some similar features between commercial and residential. On April 1 he has paid only RM400000 because it is 40 complete. However developers will pay GST on some of their production inputs.

Sale of commercial properties will be subject to 6.

Marc Dubuc Associate Cott Law Group P C Linkedin

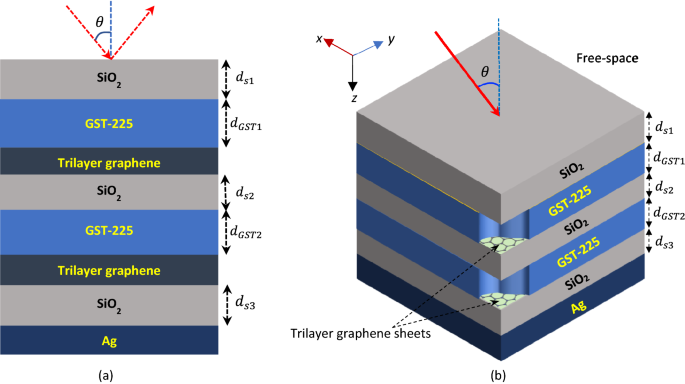

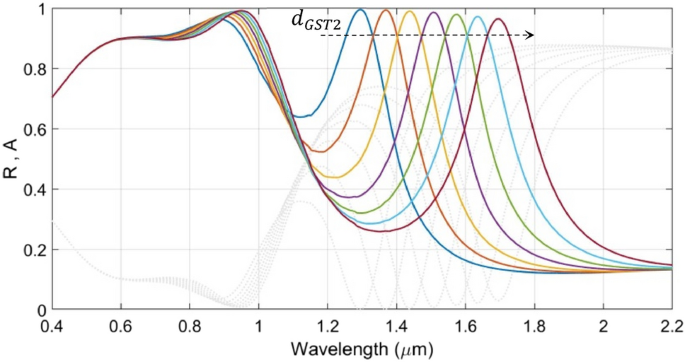

Tunable Absorber Embedded With Gst Mediums And Trilayer Graphene Strip Microheaters Scientific Reports

Bahamas Indirect Tax Guide Kpmg Global

Gst On Flat Purchase And Real Estate Rates In 2022 And Impact On Home Buyers

2018 Property Market Recap Here S 9 Things You Should Know Iproperty Com My

Tips Tricks To Commercial Property Investment In Malaysia

Update On Gst For Individual Supplying Commercial Property Propsocial

Impact Of Gst On Real Estate Sector

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

How Gst Will Impact Home Prices The Property Market

Tax Navigating The Tax Minefield Of Property Investments Wealth Mastery Academy

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Goods And Services Tax Australia Wikipedia

What Is The Difference Between Commercial And Residential Real Estate Goel Ganga Developments

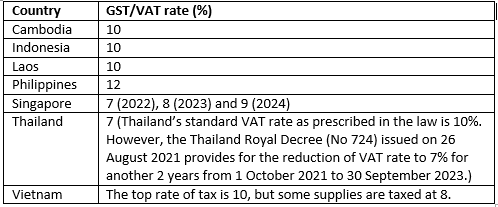

Worldwide Vat Gst And Sales Tax Guide 2022 Ey Global

Tunable Absorber Embedded With Gst Mediums And Trilayer Graphene Strip Microheaters Scientific Reports

Individual Supply Commercial Property Gst Malaysia Jaycectzx

How Gst Will Impact Home Prices The Property Market

0 Response to "gst on commercial property malaysia"

Post a Comment